ProfitScore Update – January 2022

To the clients and friends of ProfitScore:

The expectation of heightened volatility for 2022 did not disappoint in January. The VIX rose to just short of 32 in late January, its highest level since January 2021, settling at 24.38 by month’s end.

According to weekly data published by the Fed, its balance sheet as of the first part of February was 8.8 trillion dollars. That is a tremendous amount of money that is incomprehensible to think about. Consider this- The height of a stack of 1,000,000,000,000 (one trillion) one dollar bills measures 67,866 miles, so a stack of the Fed’s current total assets would be 602,189 miles which is more than the distance to the moon and back.

With inflation significantly above target and unemployment getting close to the target, the Fed is in a position to start raising rates and reducing its balance sheet. In 2013, the mere announcement of tapering caused panic selling in the U.S. Treasury markets, sending interest rates surging, known as the taper tantrum. Predictions aside, one thing seems almost certain: volatility is in our future.

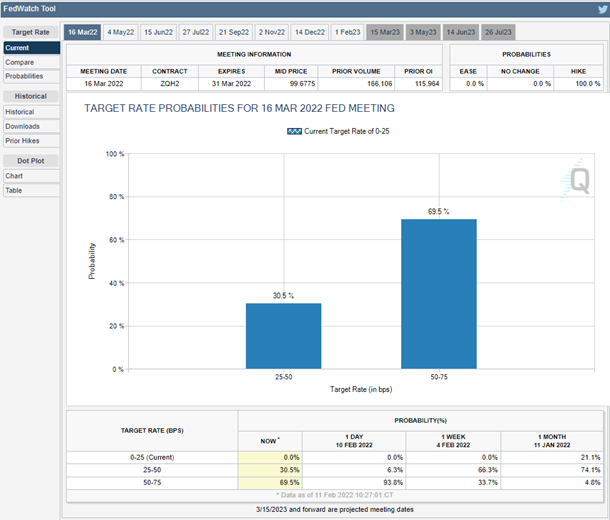

Below is a snapshot of the CME Group that predicts the rate increase as well as the link to the site – https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

Let’s put the market landscape into perspective. In January, we had tremendous volatility, tons of Fed talk, rates spiked, Omicron surging, slowing growth, continued supply chain woes, inflation, potential war, and waning stimulus! Just to name some of the issues. All of this caused risk assets and bonds to drop. The SPY was down -5.3% and the 20+ Year Treasury ETF TLT was down -3.9%.

Important disclosure information: Past performance of a ProfitScore index is not an indication of future results. You cannot invest directly in any ProfitScore index. The performance of any ProfitScore index does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in an index. A decision to invest in any such fund or portfolio should not be made in reliance on any of the statements discussed above. Inclusion of a security within any ProfitScore index is not a recommendation by ProfitScore to buy, sell, or hold such security, nor is it considered to be investment advice. Index performance does not reflect any management fees, transaction costs, or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in fund shares. Such fees, expenses, and commissions would reduce returns. ProfitScore receives compensation in connection with licensing rights to its indices. All information relating to any ProfitScore index is impersonal and not tailored to the specific financial circumstances of any person, entity, or group of persons.