ProfitScore Update – October 2022

Inflation Adjusted Equity/Bonds

To the clients and friends of ProfitScore:

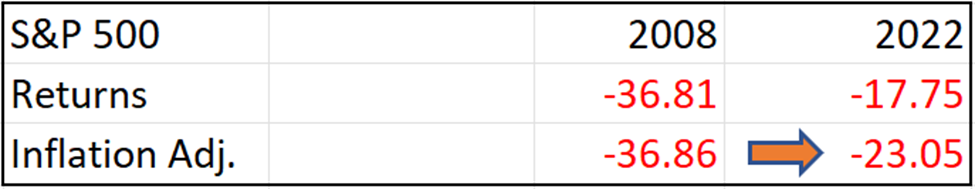

With all the talk of inflation, there is one element that you don’t see much. The S&P is down -17.75% through October, but adjusting for inflation puts the S&P down -23.05%. For reference, the S&P was down -36.81% in 2008, and inflation-adjusted was down-36.86%.

When you peer at the markets through the inflation lens, you can see how the S&P compares to 2008 regarding inflation-adjusted losses in equities. Unfortunately, this is not the whole story. If you look at 60-40 investments that might include bonds, the picture looks much more dire than in 2008. Take, for example, the TLT, which is longer-dated US Treasuries.

In 2008 bonds offset much of the risk of equities, but in 2022 both asset classes are experiencing significant losses making 2022 worse than 2008 for a diversified portfolio. Moreover, high inflation, a determined fed, and deteriorating business conditions may cause more of the same to continue for some time.

Important disclosure information: Past performance of a ProfitScore index is not an indication of future results. You cannot invest directly in any ProfitScore index. The performance of any ProfitScore index does not represent actual fund or portfolio performance. A fund or portfolio may differ significantly from the securities included in an index. A decision to invest in any such fund or portfolio should not be made in reliance on any of the statements discussed above. Inclusion of a security within any ProfitScore index is not a recommendation by ProfitScore to buy, sell, or hold such security, nor is it considered to be investment advice. Index performance does not reflect any management fees, transaction costs, or other expenses that would be incurred by a portfolio or fund, or brokerage commissions on transactions in fund shares. Such fees, expenses, and commissions would reduce returns. ProfitScore receives compensation in connection with licensing rights to its indices. All information relating to any ProfitScore index is impersonal and not tailored to the specific financial circumstances of any person, entity, or group of persons.